What is the difference between a PTR and a PTS Calculator for Pharma Companies website?

PTR PTS calculator for Pharma – PTR (Price to Retailer) and PTS (Price to Stockist) are computer programmes that assist pharmaceutical websites and biotechnology businesses in calculating contract terms, product costs, and other financial terms associated with the manufacture and distribution of pharmaceuticals. It aids in the keeping of accurate accounting records of the PTR PTS calculator for Pharma companies websites financial transactions. Accounting records are becoming increasingly vital as more PTR PTS calculator for Pharma companies websites enter the pharmaceutical manufacturing market.

Accounting, in fact, has steadily grown in the pharmaceutical field of science and has become one of the main necessities of Pharmaceutical Engineering. PTR PTS calculator for pharma is an essential feature for any pharma companies websites design. Because it helps to attract more visitors to the website. Check here why PTR PTS calculator for Pharma companies websites designing is essential for business. Get best price and latest features PTR PTS calculator for Pharma companies websites.

What is PTR (Price to Retailer) for pharma calculator?

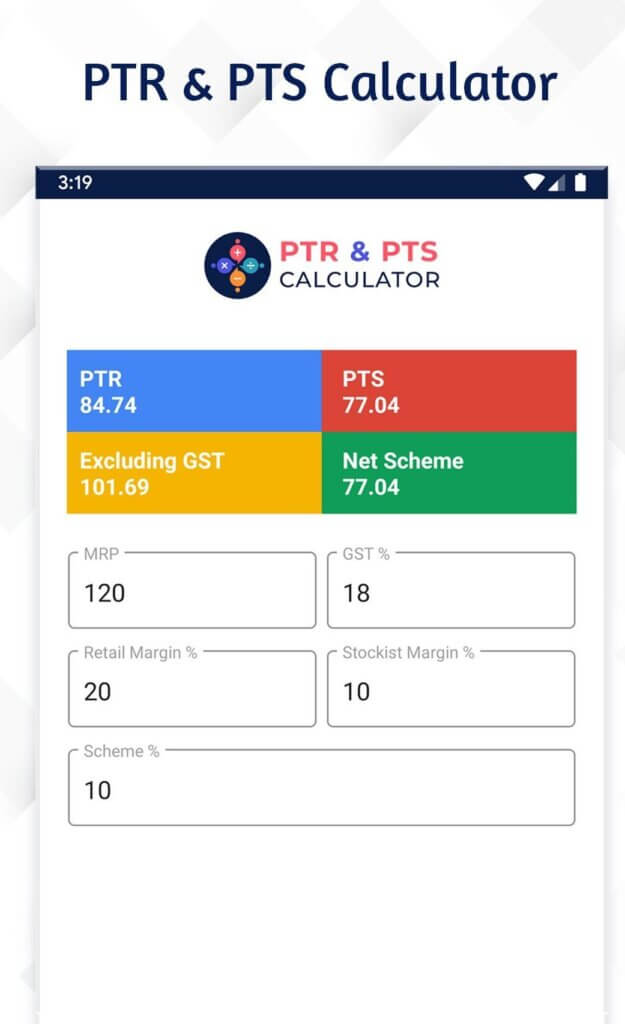

Price to Retailer is the full version of PTR. To determine net schemes, PTR is used. It’s a good quality measure that compares the cost of preventative medicine to the value given. A lower value implies that the quality of a piece of medical equipment is lower than average. For example, if you want to give a 15% scheme, this PTR calculator will calculate its own net scheme value based on the scheme percentage you specified.

What is PTS (Price to Stockist) for pharma calc?

PTS is for Price to the Stockist, while PTC stands for the price a pharmaceutical company charges its distributors or stockists for its products. GST is not included. The PTC is also known as the fee-for-service price or the price/transaction cost. This ratio is based on negotiated costs and indicates how much a provider is charged for each service performed. Higher rates normally reflect better treatment, hence it’s considered an essential economic measure for health care in PTR PTS calculator for Pharma companies websites.

What Is GST ?

GST, or Goods and Services Tax, is an indirect regressive tax that is used in India to collect customs and excise duties on imports and exports. It is a destination-based, comprehensive, single-stage indirect tax: comprehensive since it includes all other indirect taxes, with the exception of some state taxes such as stamp duty, municipal value markup, and property tax. It is intended to encourage the flow of foreign trade by taxing consumer expenses at the point of origin and channelling tax revenues to maintain internal market competitiveness.

The simplicity, extensive application, comparison with other indirect taxes, stable tax base, and rate liberalisation are all important qualities of this tax. Its goal is to provide the government with a regressive source of revenue while simultaneously encouraging domestic production and employment. The main disadvantage of this tax structure is the possibility of volatility.

What is MRP in Pharma ?

MRP stands for Maximum Retail Price and is the highest price that can be charged for a product sold in India or any other country. All taxes, including GST, are included in the MRP. It’s worth noting that sellers can’t impose GST on top of the MRP. The MRP displayed on the goods already includes GST for pharma companies websites. What is PCD Pharma’s Stock Margin? The Stock Margin is the percentage of sales that remains after all costs have been subtracted, such as taxes, reductions, interest, and other significant expenses. Preferred stock dividends are usually included in this calculation, whereas common stock distributions are usually excluded.

How to calculate PTR ?

Formula to Find PTR without use of PTR PTS calculator for Pharma

To calculate the PTR, we must first determine the Net Margin and GST Factor.

Margin of Safety (It is Inclusive of GST)

To get the Net margin, subtract the Retail percent from the MRP.

Net Margin = MRP – Retail %

GST factor (Which is helpful for subtracting the GST amount from the net margin)

GST Factor = 100 + GST% / 100

PTR = Net margin / GST Factor

Formula to Find PTS without Calculator

PTS = PTR – Stockist %

Example

Suppose,

MRP = 100

Retail % = 20 %

Stockist % = 10%

GST% = 12 %

Net Margin = MRP – Retail %

100 – 20% = 80

GST Factor = 100 + GST% / 100

100 + 12 / 100 = 1.12

PTR = Net margin / GST Factor

80 / 1.12 = 71.42

PTS = PTR – Stockist %

71.42 – 10% = 64.28

Special Instruction to calculate PTR and PTS.

To determine the net margin of any MRP by subtracting the retail percentage from the MRP.

To acquire the correct Net margin of any MRP, please calculate as follows.

Net Margin = MRP – Retail %

GST [5% / 12% / 18%]

P.T.R = (MRP – Stockist Margin) ÷ (100+GST)*100

P.T.S (If Stockist Margin is 10%) = PTR-10%

As a result, solely use the above reasoning to calculate PTR and PTS. You can also use readymade PTR PTS Calculator Application for easily finding PTR and PTS for single user use. You can also check best Top Trending Color Schemes for Pharmaceutical Websites.